How Plinqit works.

We have put together our most frequent questions, however if you have any additional questions please contact us via the secure message center within Plinqit or by emailing support@plinqit.com. We reply within 1 business day.

How does Plinqit work?

Plinqit is a savings platform that is designed to help you save more. Once you sign up for Plinqit, you will have the opportunity to get paid to save and learn about money. That’s right! You can get paid to learn about money with topics such as buying your first home, building your credit score, and investing. Throughout the process of saving with Plinqit, you will remain in complete control of how much money you choose to save and when you choose to save it.

Is my financial information secure?

Absolutely. Data security is our top priority. Plinqit uses industry-leading RSA 256-bit encryption technology.

Are there any fees for using Plinqit?

There are no service fees to use Plinqit. While setting up your goal you may choose to select a penalty to discourage yourself from early withdrawal. If you do select a penalty, a reward will also be set to payout when you complete your goal. If selected, penalties are charged each time you ‘break the bank’, however, rewards are only paid out once at goal completion.

Where are my Plinqit savings held?

Your funds are held with the financial institution that makes Plinqit available to you at no cost.

What if I have forgotten my password?

Click “Forgot Password?” below the login box to receive an email with instructions. You can also reach out to us directly at support@plinqit.com.

How do I change my username/password?

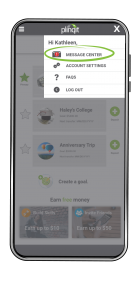

Select the (![]() ) icon in the upper right-hand side of your screen, and select Account Settings. Select the pencil icon next to the information you’d like to change.

) icon in the upper right-hand side of your screen, and select Account Settings. Select the pencil icon next to the information you’d like to change.

I have forgotten the email I used to open my account. How do I gain access to my account?

Please email us at support@plinqit.com and we will help you regain access to your account.

How long does it take to get money back into my checking account from Plinqit?

Transactions can take up to 4 business days to complete.

How do I cancel my Plinqit account?

You may close your account by contacting customer service via the secure message center within Plinqit or email us at support@plinqit.com.

Can I make a one-time deposit into my Plinqit account?

Yes! Simply select Deposit on the home screen or from the (![]() ) menu.

) menu.

Can I have more than one savings goal?

Yes! With your Plinqit account, you may create up to 5 individual savings goals.

Is there a downloadable Plinqit App for my mobile phone or other devices?

Yes! Plinqit is available for Apple (iOS), Android devices, and Amazon Kindle.

How do I contact customer service?

You can contact customer service via the secure message center within Plinqit or email us at support@plinqit.com.

You can contact customer service via the secure message center within Plinqit or email us at support@plinqit.com.